What can you do if you are in debt?

-

1. Always contact us in case of debts

Our telephone number is 088 291 10 45. Together we will look for a suitable solution.

Do you want us to call you? Request a call-back via SB@derbg.nl. Do not forget to include your telephone number. -

Apply for exemption

Maybe you can get exemption. First, do the exemption check. Then you can see if it would be sensible to apply for exemption.

You can apply for exemption via My RBG or by telephone via 088 291 11 99. (Please have your contact reference ready. This is stated in the top right-hand side of your assessment). Would you rather speak to an employee? Call team Special Asset Management at 088 291 10 45. -

Do you have more debts? Look for help

For free advice and help with resolving your debts, go to your local authority. Each municipal authority has its own regulation for this situation. You can also find more information at www.juridischloket.nl or www.geldfit.nl They can put you in touch with an accredited debt counsellor. This will prevent you from ending up with incompetent or unreliable providers.

What does the Special Asset Management team do for you?

-

- You can always pay in instalments

- Together, we will check if you meet the conditions for exemption. If you are eligible for exemption, then you will not have to pay part of the taxes.

- We will look into how much you can pay and we will agree on a special payment scheme.

- We will make sure a debt collector will not visit

- We will see if you need more help from others and will bring you into contact with other assisting organisations.

- We have a solution for everyone

What happens if you do nothing?

-

Unfortunately, we cannot take your situation into account if you do not contact us. This means we will proceed with collection. This means extra collection fees that can quickly mount up. So always contact us. This enables us to find a suitable solution together.

Why are you paying taxes to the RBG?

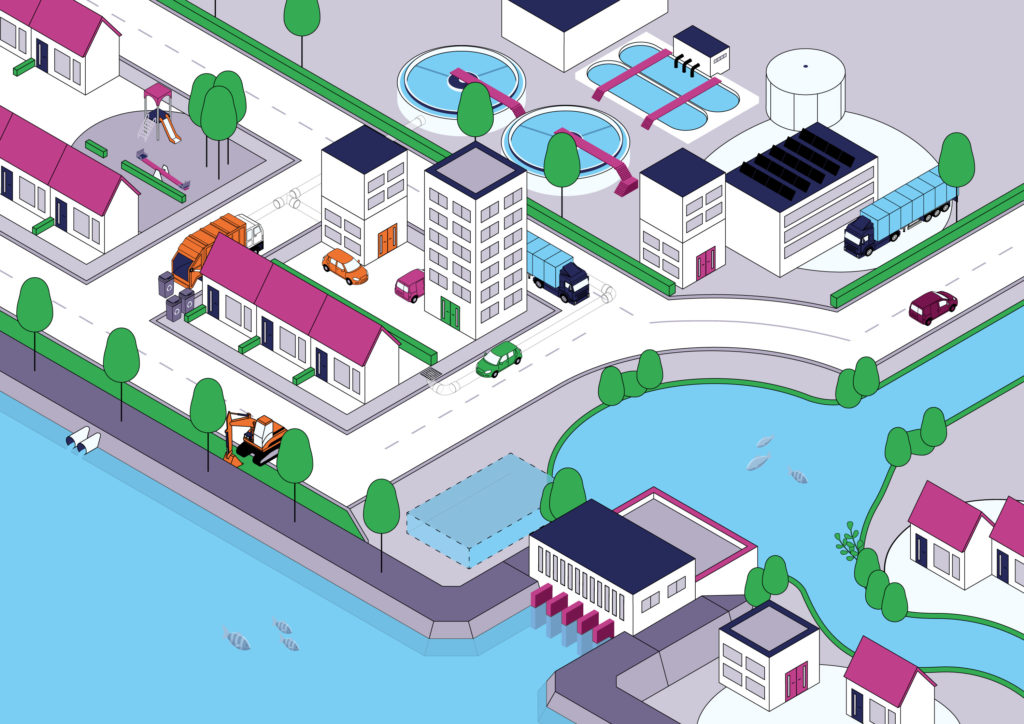

The RBG collects taxes for water councils and municipalities. You are contributing to the work water councils and municipalities do for you and others.

The water council cleans dirty water using water treatment facilities. The water councils also make sure that the chances of flooding are as slim as possible. By maintaining dykes, for example. And by pumping water. The water council also retains water in case of drought.

The municipality is in charge of waste collection and maintaining the sewer system. This is the system of pipes that transports your dirty water to the water council’s treatment facility. Moreover, the municipality also takes care of many other matters in your city. Think of trees, bushes, streets, community centres and playgrounds.

Contact your municipality

| Municipality | telephone number | Help filling forms |

|---|---|---|

| Delft | 14 015 | Formulierenbrigade Delft |

| Pijnacker-Nootdorp | 14 015 | Formulierenbrigade SWOP |

| Den Haag, Leidschendam-Voorburg, Rijswijk, Wassenaar | 14 070 | |

| Rotterdam, Capelle a/d IJssel | 14 010 | |

| Schiedam, Maassluis, | 14010 | Formulierenbrigade stroomopwaarts |

| Westland | 14 0174 | |

| Zoetermeer | 14 079 | |

| Gouda, Waddinxveen, Krimpenerwaard, Nederlek | 14 0182 | |

| Lansingerland | 010 800 40 00 | |

| Midden-Delfland | 015 380 41 11 | |

| Vlaardingen | 010 248 40 00 | Formulierenbrigade stroomopwaarts |

| Krimpen aan den IJssel | 14 0180 | |

| Zuidplas | 0180 330 300 |